Crypto

Set It and Forget It? Why Top 5 Multicap Funds for...

People who want to spend for the long term and want a plan that combines security, growth, and variety have grown to like multicap funds. These funds provide a flexible way to invest in India's growing stock markets by mixing large and mid cap...

3

min.

Business & Finance

Fintechzoom.com Economy: A Powerful Glimpse Into the Future

Imagine a world where your phone is your bank, your investments are managed by artificial intelligence, and sending money across the globe is as...

6

minutes

Fintechzoom.com Natural Gas: A Powerful New Insight

Keeping up with the fast-moving world of natural gas can feel like a full-time job. Prices swing, weather changes, and global events create a...

7

minutes

businessgrowthhacker.com phoenix business growth consultant: What You Must Know

Every business owner in Phoenix dreams of seeing their company thrive. You have the passion and the drive, but sometimes, you hit a plateau....

8

minutes

Set It and Forget It? Why Top 5 Multicap Funds for...

People who want to spend for the long term and want a plan that combines security, growth, and variety have grown to like multicap...

3

minutes

Remote Accounting Jobs: How to Find and Succeed in Them

Working remotely has become one of the most significant shifts in the modern workplace, especially for professionals in accounting. You may have the right...

3

minutes

6 Tips to Boost Your Checking Account’s Security

Keeping your financial information safe is more important than ever. With so much of our banking done online, it’s smart to take a few...

2

minutes

Stock Market

Is Forex Trading Halal In Islam? A Complete Islamic Finance Guide

Many people wonder if participating in the currency market aligns with their faith. The question of whether forex trading is halal in Islam comes...

5

minutes

The Ultimate Guide to Forex Lot Sizes and Risk Management

Welcome to this comprehensive guide on managing lot sizes and controlling risk while trading currencies. If you’re new to the forex market or looking...

5

minutes

Fintechzoom.com Nikkei 225: Shocking Trends You Need to See

The Japanese stock market has always been a fascinating arena for investors worldwide, and the Nikkei 225 index stands as its most prominent benchmark....

12

minutes

Investing

Fintechzoom com Russell 2000: The Shocking Insight You Need

Stop Looking at the Wrong Party: Why Small-Cap Stocks Tell the Real Story

Let’s be honest, watching the stock market can feel a bit like watching a party where only a few guests are dancing on the tables. Every time the news flashes an all-time...

8

min.

Trending Posts

The Importance of Being Financially Literate for Business

Financial literacy is no longer a “nice-to-have” skill for business owners—it is a fundamental requirement for survival and growth. Whether you run a startup,...

4

minutes

Top Benefits of Hiring a Workers Compensation Attorney for Your Claim

Getting injured at work launches a complex legal process that most employees are unprepared to handle alone. Workers compensation claims involve strict deadlines, detailed...

5

minutes

Best jewish wigs factory 2026

Determining the best Jewish wig factory depends on factors such as personal preference, style, budget, and the quality of materials. However, based on reputation,...

3

minutes

Best Guest Posting Service – Marketplace #1 ranknewly

In the ever-evolving world of digital marketing, guest posting has emerged as a cornerstone strategy for building authority, driving traffic, and enhancing search engine...

7

minutes

How to Design and Use a Print Free Flyer for Your...

In today’s digital world, event marketing has become more efficient and effective, thanks to online tools that allow you to print free flyer designs...

4

minutes

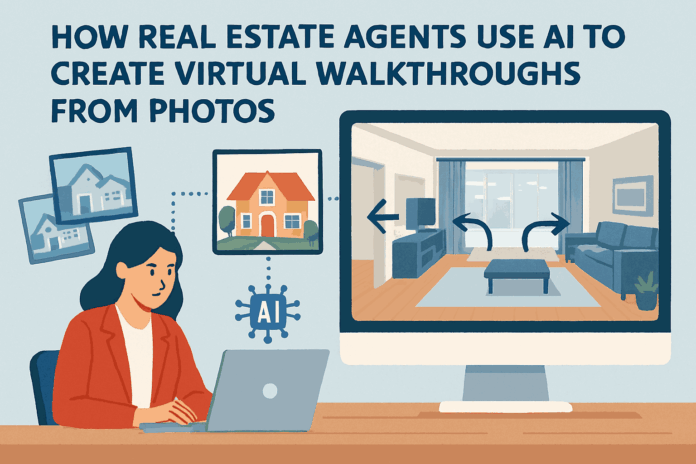

How Real Estate Agents Use AI to Create Virtual Walkthroughs From...

The real estate industry has changed dramatically in the last few years, especially as buyers expect to explore properties digitally before ever stepping inside....

5

minutes